does texas have an inheritance tax 2019

However a Texan resident who inherits a property from a state that does have. October 16 2019.

Free Consultation Confirmation Holman Law

As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117.

. Inheritance tax rates differ by the state. Some states have inheritance tax some have estate tax some have both some have none at all. How does inheritance tax work.

When someone dies the government needs to know the total value of their assets less their liabilities any outstanding debts they have. Additionally they may have to pay additional federal or state taxes. On the one hand Texas does not have an inheritance tax.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. See where your state shows up on the board. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There are no inheritance or estate taxes in Texas. In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. The state repealed the inheritance tax beginning on Sept.

March 1 2011 by Rania Combs. In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. Twelve states and the District of. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

These states have an inheritance tax. As of 2021 the six states that charge an inheritance tax are. Minnesota has an estate tax for any assets owned over 2700000 in 2019.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Fourteen states and the District of Columbia impose an. This means that if you have 3000000 when you die you will get taxed on the 300000 over the.

Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. Biological children have strong inheritance rights in the state of Texas. Be aware of the 15000 federal gift tax which allows you to make an annual gift of up to 15000 without taxes.

1206 million will be void due to the federal tax exemption. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the. The Texas Franchise Tax.

As of 2019 only twelve states collect an inheritance tax. Texas repealed its inheritance tax law in 2015 but other. The estate tax rate is currently 40.

That said you will likely have to file some taxes on behalf of the deceased including. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Does Texas Have an Inheritance Tax or Estate Tax.

The estate tax is different from the inheritance tax which is taken by the government after money or possessions have been passed on to the deceased persons heirs. T he short answer to the question is no. The tax did not.

The state also has ruled that adopted children have the same inheritance rights as biological children. With a base payment of 345800 on the first 1000000 of the estate. However a Texan resident who inherits a property from a state that does have such tax will still be responsible.

As of 2019 if a person who dies leaves behind an. There is a 40 percent federal tax however on estates over.

What You Actually Take Home From A 50 000 Salary In Every State Gobankingrates

𝐀𝐢𝐥𝐞𝐞𝐧 𝐋𝐢𝐠𝐨𝐭 𝐃𝐢𝐳𝐨𝐧 Attorney At Law Home Facebook

Adjournment High Resolution Stock Photography And Images Alamy

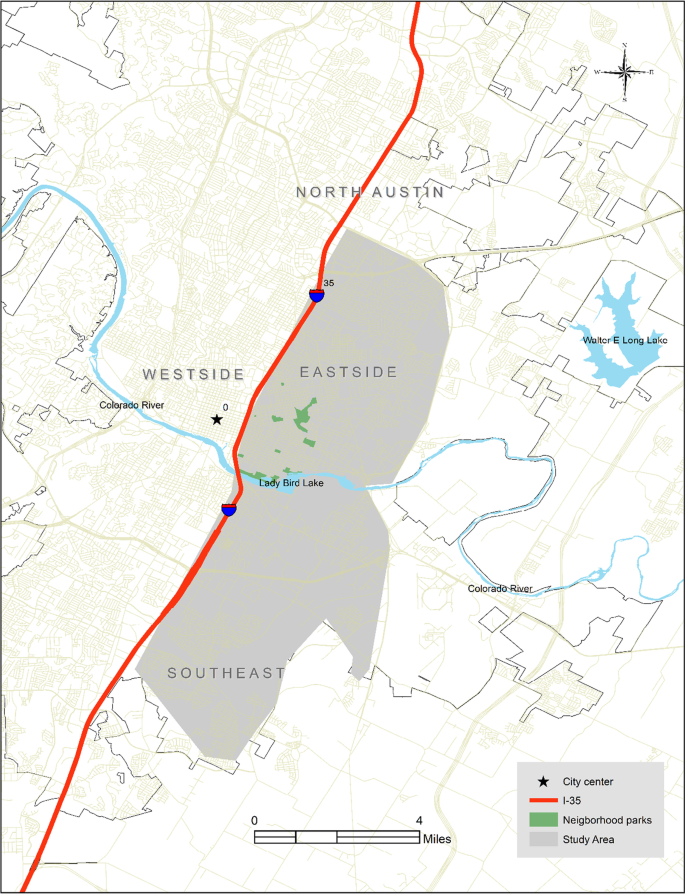

Tracey A Ruhlman S Research Works University Of Texas At Austin Tx Ut And Other Places

Redistricting Updates And Of Course Texas Ballotpedia News

Tracey A Ruhlman S Research Works University Of Texas At Austin Tx Ut And Other Places

Pin On Employment Layers In Dubai

Adjournment High Resolution Stock Photography And Images Alamy

Hsin Yao Chang Zahabizadeh Law Clerk Cao Associate P C Linkedin

Redistricting Updates And Of Course Texas Ballotpedia News

Claire Burrows Texas Book Festival

Overview Of The Squatting Laws In Texas Bigham Associates

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Facts To Be Considered To Buy Your House In Massachusetts Facts Mindfulness Stuff To Buy

Foreign Inheritance Taxes What Do You Need To Declare

Tracey A Ruhlman S Research Works University Of Texas At Austin Tx Ut And Other Places

Social And Structural Determinants Of Self Rated Health In Gentrifying Neighborhoods In Austin Texas A Cross Sectional Quantitative Analysis Springerlink